Astoria Photo via Getty Images

May 2, 2024 By Ethan Marshall

During the first quarter of 2024, the average price for closed condos in Astoria went up 11% year-over-year, according to the Q1 report by the real estate firm Modern Spaces.

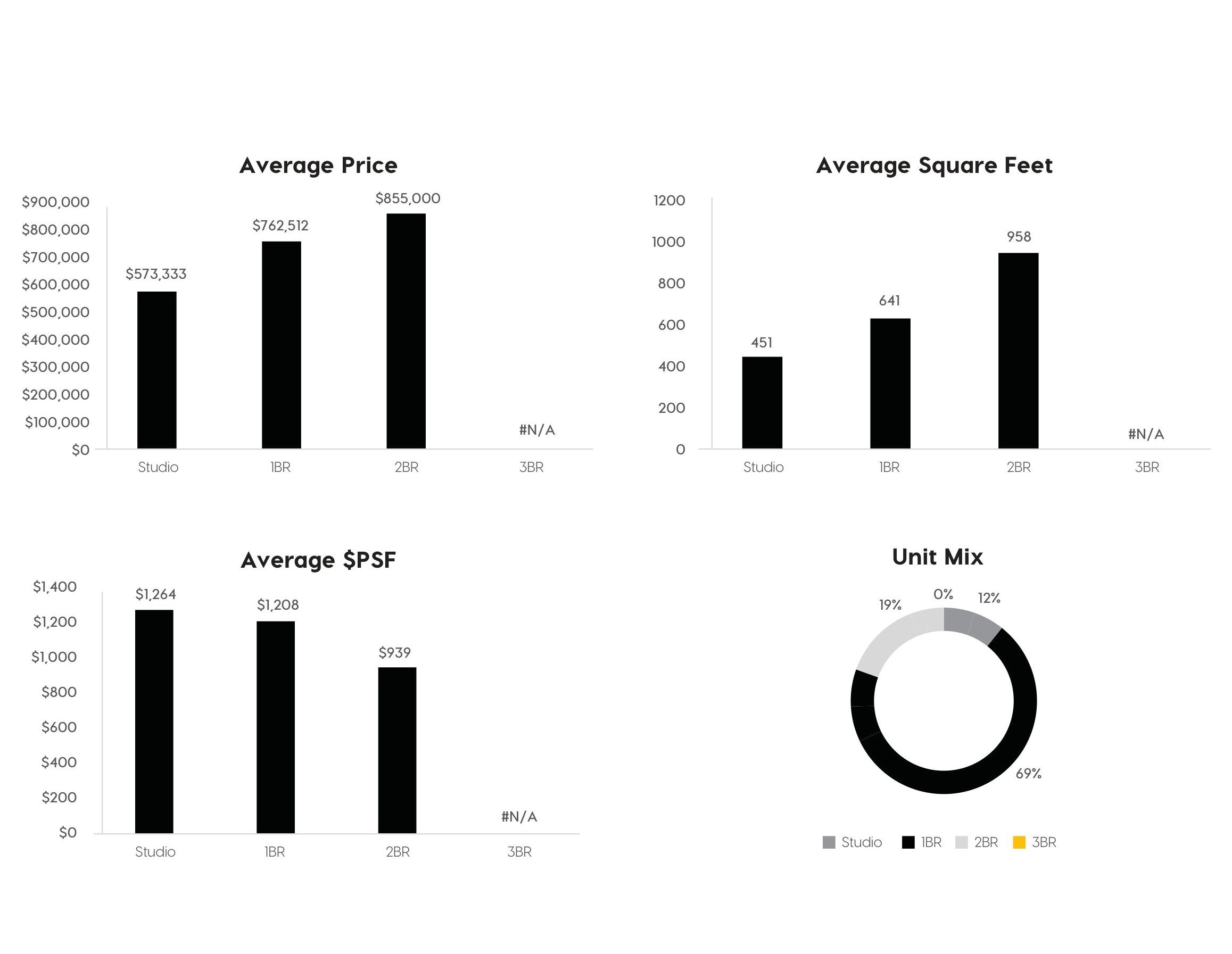

The Astoria condo market saw a notable increase in average closing prices, climbing from $683,307 in the first quarter of 2023 to $758,470 in the same period in 2024. A breakdown of this quarter’s average prices reveals that studio units sold for $573,333, one-bedroom units for $762,512, and two-bedroom units for $855,000.

A breakdown of the closed condos in Astoria during the first quarter of 2024. Photo courtesy of Modern Spaces

Another notable trend in Astoria was the significant decline of in-contract volume. The number of these condos fell 64% year-over-year, from 45 in 2023 to 16 in 2024.

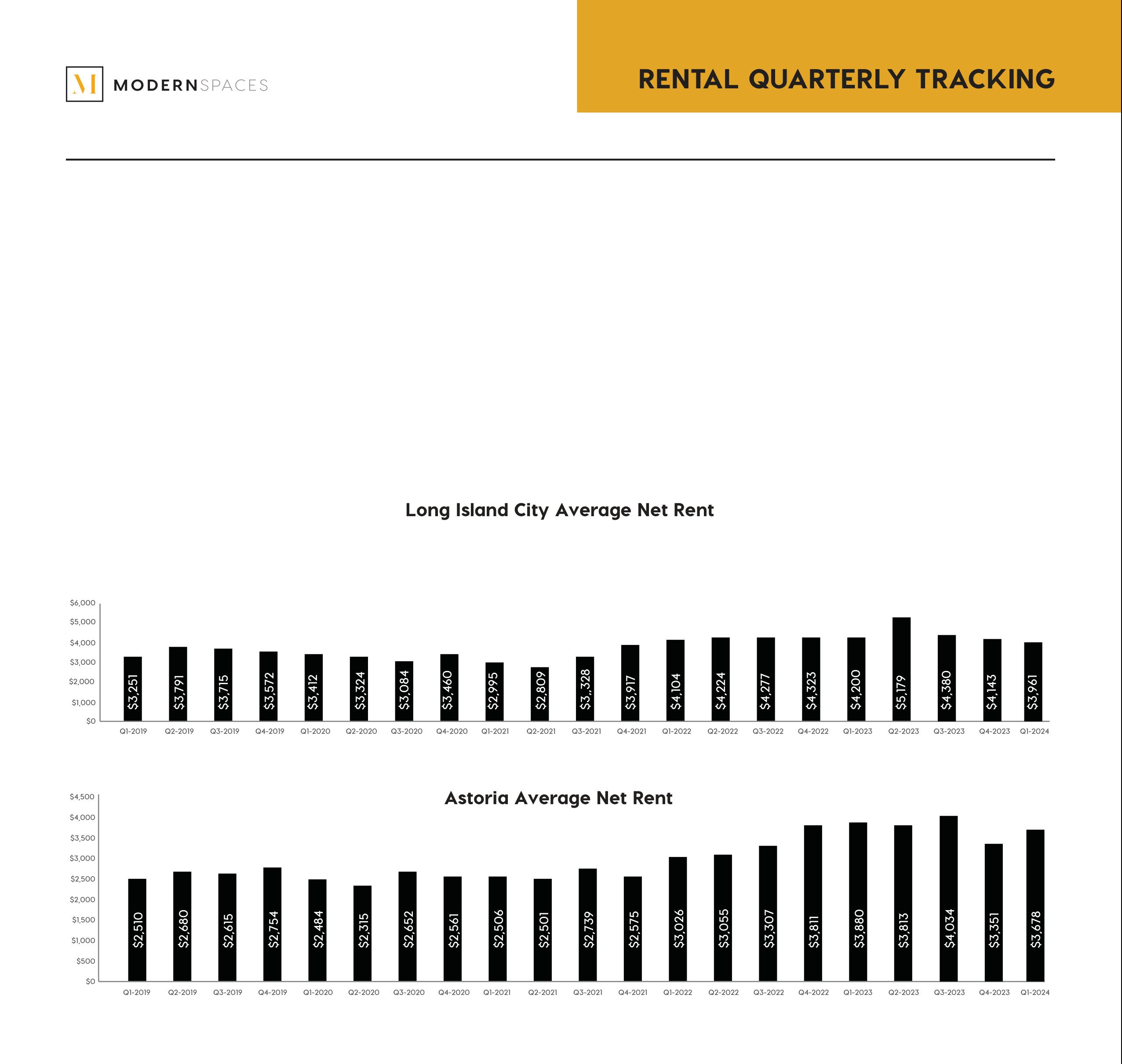

Rentals in Astoria decreased in price and volume over the same period. The net rent dropped 5%, from $3,880 in the first quarter of 2023 to $3,678 in the first quarter of 2024. The total volume of these units went down 6%, from 171 last year to 160 this year.

There was little change in the closed price of condos in Long Island City year-over-year, increasing just 0.5% over that span, from $1,214,622 to $1,220,695.

While the in-contract volume in Long Island City suffered a large decline year-over-year, it was still much less than what was seen in Astoria. The in-contract volume in Long Island City dropped 35%, from 79 units to 51.

Rentals in Long Island City followed much more similar trends to those in Astoria. As was the case with Astoria, net rent decreased 5% in Long Island City, from $4,200 in 2023 to $3,961 in 2024.

The closed price of condos in Flushing followed opposite trends to those in Astoria. Unlike in Astoria and Long Island City, the closed price of condos in Flushing decreased year over year. Over this period, there was a 9% decrease, from $930,371 in 2023 to $846,637 in 2024.

Photo courtesy of Modern Spaces

The real estate market in the first quarter of 2024 reflected varied trends in these different Queens neighborhoods, as well as the types of property. Based on these differentiating trends, Modern Spaces predicts continued adjustments in the second quarter of the year, as the real estate market works to adapt to updated buyer preferences and economic conditions. Some of the biggest influencing factors expected by Modern Spaces include supply dynamics, rental trends and the performance of the luxury sector.